By Iniubong Sam

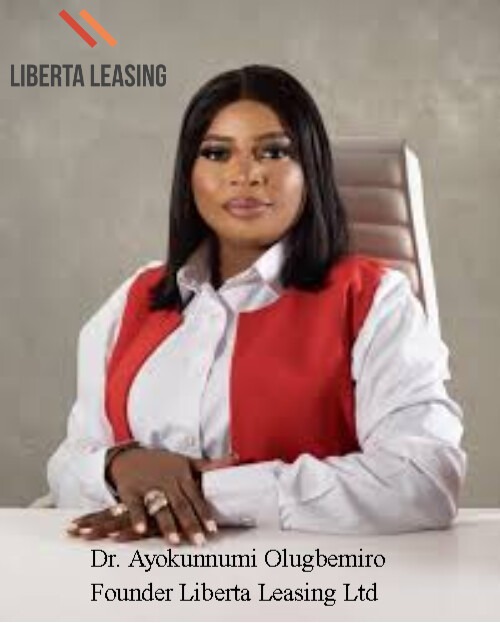

A quiet revolution is reshaping the Nigerian financial sector, one led by women who refuse to remain sidelined. At the forefront is Dr. Ayokunnumi Olugbemiro, founder and CEO of Liberta Leasing Limited, whose vision is rewriting the rules of access to finance in Nigeria.

In just five years, under her leadership, Liberta Leasing has risen into a powerhouse, providing credit and leasing solutions to individuals and businesses long neglected by traditional banks. Her mission is simple yet bold: to democratize finance, giving market traders, small entrepreneurs, and everyday dreamers the resources they need to thrive.

A chartered accountant, investment analyst, and seasoned finance executive, Dr. Olugbemiro didn’t just launch a company; she sparked a movement. Her journey is one of resilience, innovation, and unwavering commitment to financial inclusion.

In a country where women occupy less than 20% of top financial leadership roles, her ascent is nothing short of extraordinary. The secret to Liberta Leasing’s success lies in its tailored approach: offering products designed for individuals and enterprises outside the conventional banking profile. From small-scale traders in Lagos markets to ambitious tech startups in Abuja, Liberta is empowering the “underserved” to rise.

For Dr. Olugbemiro, finance is not about exclusion, it is about empowerment. Her unique balance of discipline and compassion is already making ripples in Nigeria’s volatile economy.

Yet, her story is part of a broader movement of women redefining Nigeria’s financial future. Bolaji Agbede, as Acting Group CEO of Access Holdings, oversaw a historic ₦351 billion capital raise in 2024, making Access Bank the first to meet the Central Bank of Nigeria’s ₦500 billion capital requirement well before the 2026 deadline. Meanwhile, Ireti Samuel-Ogbu, newly appointed Chairperson of the Africa Finance Corporation (April 2025), brings 36 years of international banking expertise to drive transformative infrastructure projects across Africa.

These trailblazers are breaking glass ceilings and demonstrating that finance is more than numbers; it is vision, empathy, and impact. In an era of currency volatility, inflation, and regulatory pressures, Nigeria needs innovative, inclusive financial services more than ever. Women like Dr. Olugbemiro are answering that call, fueling small businesses, widening access, and propelling economic growth.